Depreciation tax savings formula

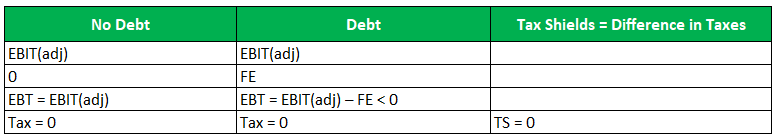

As such the shield is 8000000 x 10 x 35 280000. The depreciation for year one is 2000 5000 - 1000.

Depreciation Tax Shield Formula And Calculator

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly.

. In this method a business will divide the total cost of an asset into equal parts for the useful life years. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. 2 x 010 x 10000 2000.

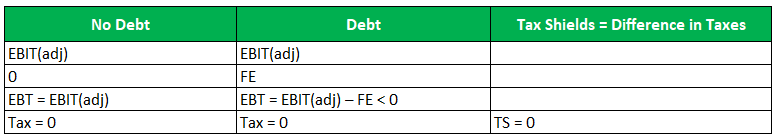

Example Calculation Using the Section 179 Calculator. Depreciation or CCA tax shield depreciation or CCA amount x marginal tax rate 75000 x 35 26250 7. Depreciation 0 million EBIT 14 million 4 million 10 million Scenario B.

Tax Savings on Above 37 of 300000 111000. This means that by listing depreciation as an expense on their. 35000 - 10000 5 5000.

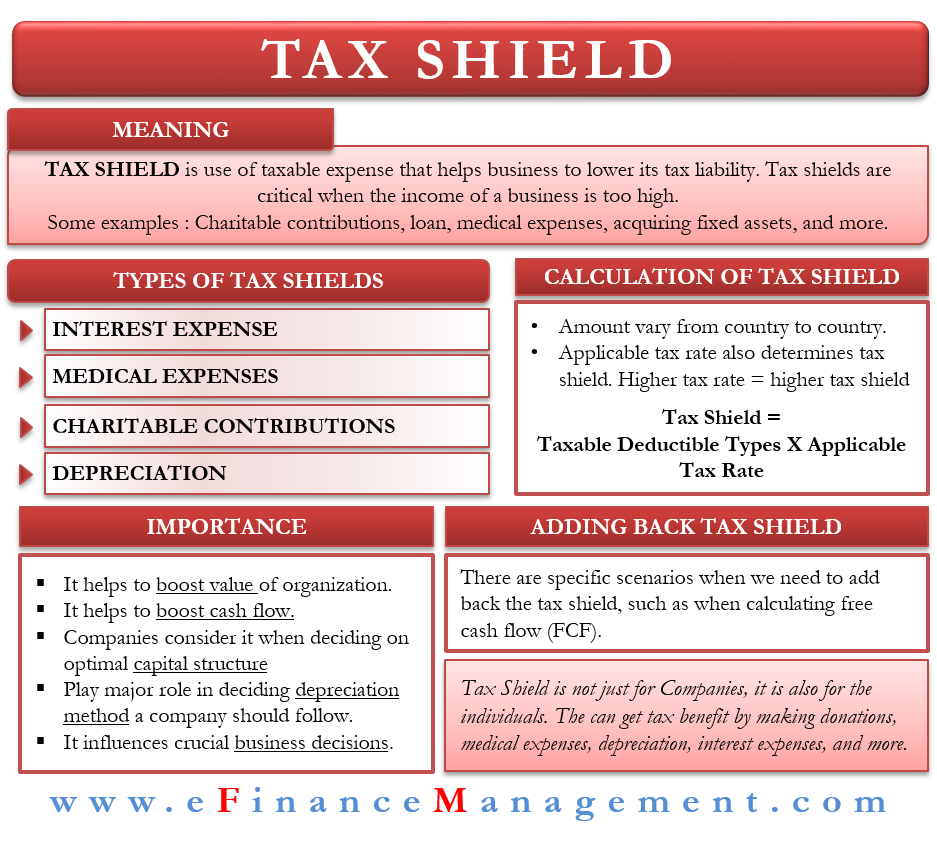

This is equivalent to the. 2 x straight-line depreciation rate x book value at the beginning of the year. A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on.

Depreciation 2 million EBIT 14 million 4 million 2 million 8 million The difference in EBIT. Recapture Tax Paid at Sale 25 on 300000 75000 Net Savings in Taxes from Depreciation. All you need to do is multiply depreciation expense for tax purposes and.

What is the amount of the operating cash flow for a firm with. Businesses use the depreciation tax shield approach to deduct the cost of assets from their taxes. By using the formula for the straight-line method the annual depreciation is calculated as.

It can be calculated by multiplying the. Net book value - salvage value x depreciation rate. For instance if the useful life of a computer is five.

This means the van depreciates at a rate of. The annual depreciation would be computed first and then multiplied by 30 or 030 to find the annual tax savings from depreciation tax shield. Tax depreciation refers to the depreciation expenses of a business that is an allowable deduction by the IRS.

Youll write off 2000 of the bouncy castles value in year. To find the depreciation value for the first year use this formula.

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Income Taxes In Capital Budgeting Decisions Chapter Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Tax Shield Formula Step By Step Calculation With Examples